Finance Minister Nirmala Sitaraman has presented the Union Budget 2023. This is the 5th time, Finance Minister Nirmala Sitharaman has presented the Union Budget and she has presented the financial statements and tax proposals for the fiscal year 2023-2024. The Chief Economic Advisor of India, V Anantha Nageshwar released the economic survey 2022-2023 on 31st January 2023.

The Union Budget of India is the annual budget of India. The Ministry of Finance under the Government of India presents the Union Budget every year. Union Budget keeps the account of the government’s finances for the fiscal year that runs from 1st April to 31st March. Union Budget is classified into Revenue Budget and Capital Budget.

Revenue budget includes the government’s revenue receipts and expenditure. There are two kinds of revenue receipts, tax and non-tax revenue. Capital Budget includes capital receipts and payments of the government.

Today, Finance Minister Nirmala Sitaraman presented the Union Budget in the parliament. She announced the budget at her speech which began at 11 AM sharp. The Budget announcement came with tons of relief for middle class citizens of India.

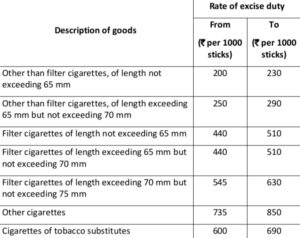

Finance Minister announced that smoking will become more expensive as the government has increased custom duty on cigarettes to 16%

Beside cigarette, Jewlery made of gold and silver are going to be expensive as basic customs duty has been hiked on articles made from gold bars.

Things which got expensive:

- Articles made from gold and platinum

- Articles made of silver

- copper scrap

- compounded rubber

- cigarettes

- Imported electric Kitchen chimney

Things which got cheaper:

- Camera lenses for phones, laptops, and DSLRs

- Parts of TV panels

- Lithium-ion batteries

- Denatured ethyl alcohol

- Domestic manufacture of shrimp

- Seeds used in the manufacture of diamonds

FM announced lower tax rates for new cooperative societies. The government also introduced new Income tax return (ITR) forms for easier filing of returns, said FM Nirmala Sitaraman. The income tax returns processing period has been reduced by 16 days, added Finance Minister.

As Finance Minister was announcing further budgets, the benchmark BSE Sensex surged over 1,000 points to the scale over 60,500-mark as investors cheered announcements by Nirmala Sitaraman. The broader NSE Nifty went up 258 points and trading at 17,920.

The finance minister also proposed to hike tax exemption on leave encashment on retirement of non-government salaried employees to Rs 25 Lakh from 3 Lakh. “We are also making the new income tax regime the default tax regime; however, citizens will continue to have the option to avail the benefits of the old tax regime.” FM said.

For pensioners, the finance minister announced extending the benefit of standard deduction to new tax regime. Each salaried person with an income of Rs. 15.5 lakh or more will benefit by Rs. 52,500. Finance Minister Nirmala Sitaraman, while presenting the Union Budget in Parliament said, “A person earning Rs 9 Lakh a year will now be paying just Rs 45,000 instead of Rs. 60,000 currently. Similarly, a person earning Rs 15 lakh will now pay only 10% of this as tax.”

New income tax slabs 2023-2024:

- Rs 0 to Rs 3 lakh – Exempt

Rs 3 to 6 lakh – 5%

Rs 6 to 9 lakh – 10%

Rs 9 to 12 lakh – 15%

Rs 12 to 15 lakh – 20%

Above Rs 15 lakhs – 30%

Under the old tax slabs, the rates were:

- Income till Rs 2.5 lakh – Exempt

Rs 2.5 to Rs 5 lakh – 5%

Rs 5 lakh to Rs 7.5 lakh – 15%

Rs 7.5 lakh to Rs 10 lakh – 20%

Above Rs 10 lakh – 30%

Finance Minister Nirmala Sitharaman announced a number of changes in the income tax slabs in the new tax regime. An individual won’t have to pay any taxes on income up to Rs 7 lakh in new tax regime if we include all rebates. An individual with annual income of Rs 9 lakh will have to pay only Rs 45,000 as tax in new regime. This is only 5% of a taxpayer’s income in the new tax regime. There is a standard deduction of Rs 52,500 in the new tax regime. The table below shows the new tax slabs of 2023-24.

FM on Wednesday announced a cut in customs duty on import of certain inputs for mobile phone manufacturing. In her Budget 2023-24 speech, she said India’s mobile phone output rose from 5.8 crore units in 2014-15 to 31 crore units last fiscal.

The government on Wednesday proposed to extend income tax benefits to startups incorporated till March 2024. Nirmala Sitharaman also said that the government proposes to increase the benefit of carrying forward losses for startups to 10 years. “I propose to extend the date of incorporation for income tax benefits to startups from March 31, 2023, to March 31, 2024. I further propose to provide the benefit of carry forward of losses on change of shareholding of startups from seven years of incorporation to ten years,” she announced.

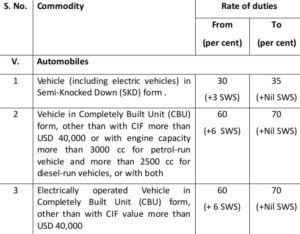

FM said announced that automobiles (Luxury cars and EVs) are going to cost more as government raised custom duty from 60% to 70% on these items in Budget 2023.

Finance Minister Nirmala Sitaraman on Wednesday proposed to double the deposit limit for Senior Citizen Savings Scheme to Rs. 30 Lakh and Monthly Income Account Scheme to Rs 9 Lakh.

In the Union Budget presented in Parliament by Finance Minister Nirmala Sitaraman on Wednesday, a total of Rs 1.62 lakh crore has been set aside for capital expenditure that includes purchasing new weapons, aircraft, warships and other military hardware.

In the end, PM Modi addressed the nation after budget presentation and congratulated Finance Minister Nirmala Sitaraman for a successful Budget.