Monetary Policy Meeting Outcome

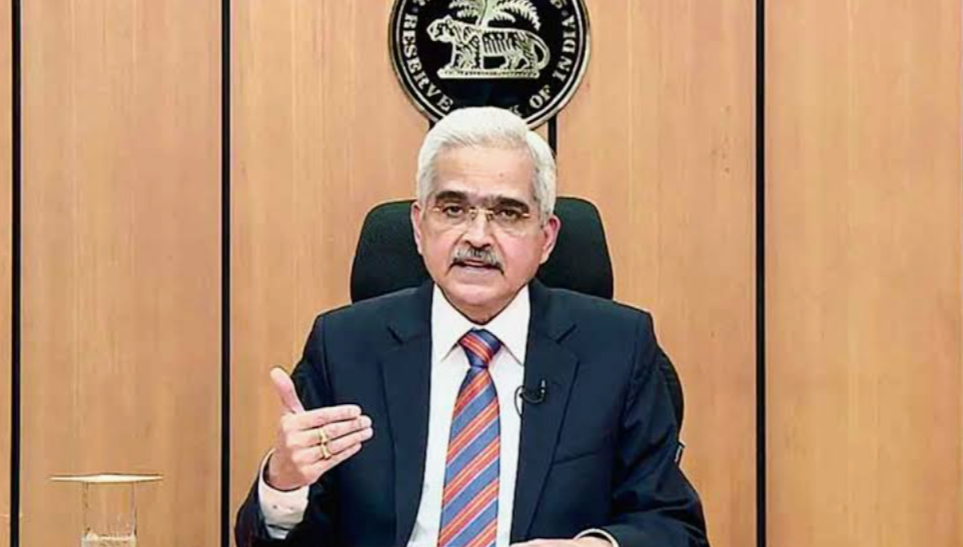

The outcome of the three-day Monetary Policy Meeting was announced by the Reserve Bank of India (RBI) Governor Shaktikanta Das on June 8. At 10 am the Governor stated in his statement and announced the decision of the MPC (Monetary Policy Committee of India) to keep the policy repo rate unchanged at 6.50%.

MSF (Marginal Standing Facility) Rate and Bank Rate are unchanged at 6.75%. SDF rate is unchanged at 6.25%. RBI keeps its monetary policy stance at the withdrawal of accommodation. MPC voted in a 5:1 majority to maintain the withdrawal of the Accommodation stance to ensure that inflation progressively aligns with the target while supporting growth.

RBI projects CPI inflation for FY24 at 5.1%.

Q1: 4.6%

Q2: 5.2%

Q3: 5.4%

Q4: 5.2%

FY24 GDP growth projection remains unchanged at 6.50%. FY24 Inflation Projection lowered to 5.1% from 5.2%.

RBI GOVERNOR’S SPEECH HIGHLIGHTS

RBI Governor Shaktikanta Das in his speech said, “In these challenging times, the Reserve Bank of India (RBI) has continued to focus on preserving price and financial stability while ensuring an adequate flow of financial resources to all production sectors of the economy.”

“As a result, domestic macroeconomic fundamentals are strengthening. Economic activities exhibiting resilience, inflation has moderated, the current account deficit has narrowed, and foreign exchange reserves are comfortable, fiscal consolidation is also ongoing. The Indian banking system remains stable and resilient, credit growth is robust, and domestic financial markets have evolved in an orderly manner,” he added.

DURING PRESS CONFERENCE

“Nearly 50% of 2000 rupee notes have been deposited in the bank,” says the RBI Governor. He also appealed to the general masses to exchange/deposit 2000 notes and not to wait till the deadline. “Don’t panic, no rush, but don’t keep it for the last days of September,” RBI Governor said.

Swati Khandelwal from Zee Business asked for a response on behalf of the general masses, as RBI has withdrawn 2000 notes will the same be done with 500 and will they issue 1000 notes in the market anytime soon? To which the Governor replied, “I don’t have any information as of now, through you I would like to convey to the masses that do not spread any kind of speculation in the market”.

Miss Latha Venkatesh from CNBC-TV18 asked about all the details of 2000 rupee notes, how much has come back so far? How much of it was exchanged and how much of it came as a deposit? To which the Governor reacted, “As of 31st March 2023 total of 3.62 lakh crores of 2000 rupee notes were in circulation after the announcement we made, a total so far about 1.8 lakh crores of 2000 bank notes came back.” “About 85% of 2000 notes are coming back as deposits into bank accounts,” he further added.

Jeevan from Akashvani asked when will CBDC (Central Bank Digital Currencies) be publicly launched and when will the common masses be able to use it. To which Deputy Governor Rabi Sankar responded, “As of now, by the end of June we should have 1 million customers and we are planning to make UPI interoperable with its QR code.”