In the fast-evolving landscape of Bollywood filmmaking and marketing, execution simulation has emerged as a valuable strategy for ensuring the smooth rollout of large-scale promotional campaigns and production processes. Execution simulation involves the detailed planning and rehearsal of campaign activities, release sequences, or even scene setups before their actual implementation. This proactive approach allows filmmakers and marketing teams to identify potential challenges, fine-tune logistics, and optimize coordination among various stakeholders.

For example, before launching a nationwide trailer release or orchestrating a multi-city promotional tour, Bollywood teams often conduct simulation exercises to predict audience response, manage technical requirements, and streamline event execution. Films like “Pathaan” and “Jawan” have benefited from such simulations, where pre-launch rehearsals and mock campaigns helped the teams deliver high-impact, seamless experiences for both audiences and partners. By embracing execution simulation, Bollywood ensures that creative vision is translated into successful on-ground and digital initiatives, minimizing risks and maximizing engagement.

Execution Simulation: Mock Social Media Rollouts, Press Releases, and Influencer Briefs

Execution simulation is the process of rehearsing or staging promotional activities before they go live, ensuring flawless execution and maximum impact. In the Indian film industry, this practice is increasingly used for social media campaigns, press releases, and influencer collaborations to anticipate challenges, refine messaging, and optimize timing.

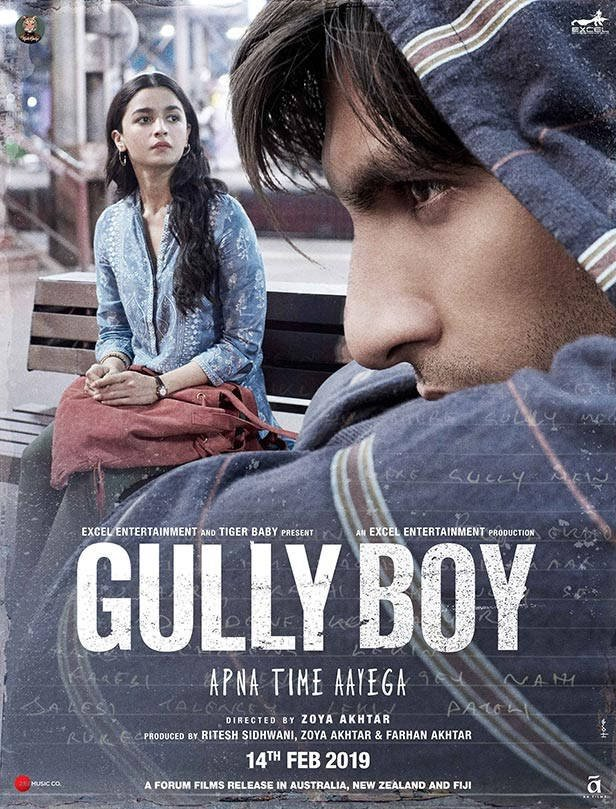

Case Study: “Gully Boy” (2019)

1. Mock Social Media Rollouts:

Before launching the first “Gully Boy” trailer and music singles, the marketing team conducted internal simulations. They tested various posting times, visual creatives, and hashtag strategies across platforms like Instagram, Twitter, and Facebook to predict engagement patterns and identify the most impactful launch sequence. This allowed them to schedule posts for maximum reach, coordinate trending hashtags, and prepare for high-volume fan interaction.

2. Press Release Dry Runs:

Drafts of press releases announcing event dates, cast interviews, and music launches were circulated among internal teams and select media partners for feedback. By simulating the press release distribution, they ensured messaging consistency and readiness to handle press queries, minimizing the risk of miscommunication.

3. Influencer Briefs:

The team developed detailed influencer briefs and ran simulations wherein influencers, including hip-hop artists and youth icons, were guided on messaging, hashtags, and timing. This rehearsal helped synchronize influencer posts with key campaign milestones, amplifying the film’s digital presence on launch days.

Outcome:

The coordinated effort resulted in “Gully Boy” trending nationwide on social media, widespread media coverage, and organic influencer engagement, contributing to the film’s strong box office opening and cultural impact.

Other Examples

- “Pathaan” (2023):

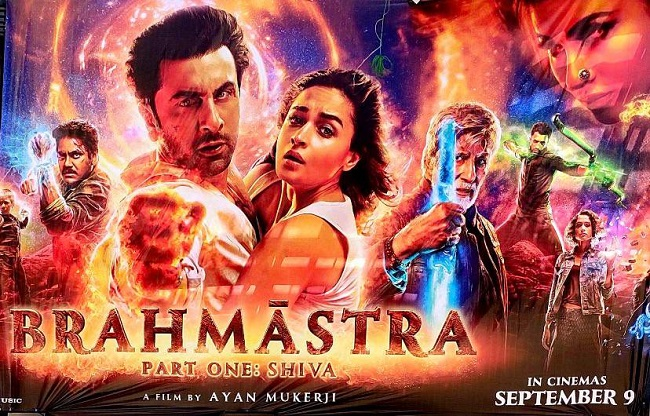

Before the official trailer drop, Yash Raj Films’ digital team conducted mock rollouts to test server loads, hashtag virality, and emergency protocols for handling negative comments or leaks. - “Brahmāstra” (2022):

Simulated influencer campaigns ensured that prominent content creators and Bollywood stars posted coordinated messages, maximizing reach and creating a sense of event around each new asset release.

Conclusion:

Execution simulation of social media campaigns, press releases, and influencer briefs enables Indian film teams to anticipate challenges, streamline communication, and create well-coordinated promotional blitzes. These rehearsals are increasingly vital for ensuring that marketing efforts land effectively in a competitive, high-stakes environment like Bollywood.

Execution Simulation in Tollywood: Examples and Case Study

Execution simulation refers to the practice of rehearsing promotional strategies—like social media campaigns, press releases, and influencer collaborations—before their public launch. This helps ensure flawless implementation, consistent messaging, and maximum audience impact. Tollywood, known for its innovative marketing, has effectively used these techniques for several big-ticket releases.

Case Study: “RRR” (2022)

1. Mock Social Media Rollouts:

For “RRR,” the team conducted internal simulations of teaser and trailer launches. They experimented with different posting schedules, hashtag strategies, and content formats across platforms, including Twitter, Instagram, and Facebook. The aim was to determine optimal post timings and hashtags (#RRRMovie, #RRRTrailer) that would trend and maximize fan engagement both in India and internationally. Simulations also included rehearsing rapid responses to anticipated fan queries or viral moments.

2. Press Release Simulations:

The PR team drafted and internally reviewed press releases announcing cast appearances, release date changes, and milestone achievements (such as record-breaking pre-release business). Mock distributions were performed to key media contacts to ensure clarity and consistency and to prepare for possible media questions or crisis situations (e.g., pandemic-induced delays).

3. Influencer Brief Simulations:

Tollywood stars like Ram Charan and Jr. NTR, as well as South Indian influencers and content creators, received detailed briefs about when and how to post about “RRR.” The marketing team ran mock influencer campaigns, synchronizing posts with key milestones such as teaser drops and music launches. Influencers rehearsed sharing reaction videos, challenges, and countdowns, ensuring uniform messaging and timing.

Outcome:

These simulations helped “RRR” dominate social media trends during every promotional event. The trailer and song launches set YouTube records, and influencer campaigns contributed to massive digital conversations, making “RRR” a pan-India and global box office phenomenon.

Other Tollywood Examples

- “Baahubali 2” (2017):

The marketing team orchestrated mock rollouts for major reveals, tested server loads for the official website, and coordinated influencer posts supporting #WKKB (Why Kattappa Killed Baahubali), ensuring that every release was a digital event. - “Pushpa: The Rise” (2021):

Influencer simulations were conducted for the viral “Srivalli” step challenge, preparing content creators ahead of the song launch so that dance covers and reaction videos could flood social media immediately upon release.

Conclusion:

Execution simulation—through mock social media rollouts, rehearsed press releases, and coordinated influencer briefs—has become a best practice in Tollywood. These strategies help teams anticipate challenges, synchronize large-scale campaigns, and amplify their film’s reach, contributing directly to the massive success of modern Telugu cinema across India and worldwide.

Execution Simulation in Mollywood: Mock Social Media Rollouts, Press Releases, and Influencer Briefs

Execution simulation involves rehearsing key promotional activities—such as social media campaigns, press releases, and influencer partnerships—before they are made public. This proactive approach helps Mollywood filmmakers ensure their promotional messaging is well-coordinated, impactful, and free from potential pitfalls, maximizing the effectiveness of each campaign.

Case Study: “Drishyam 2” (2021)

1. Mock Social Media Rollouts:

For “Drishyam 2,” the digital marketing team conducted internal simulations of teaser and trailer launches. They tested various post timings on platforms like Facebook, Twitter, and Instagram to identify the best slots for maximum engagement. Hashtag usage (#Drishyam2, #GeorgeKuttyReturns) and creative formats were also trialed to see which versions resonated best during the test runs.

2. Press Release Simulations:

Drafts of press releases announcing the film’s direct release on Amazon Prime Video, as well as key cast interviews and milestone achievements, were circulated internally and among trusted media partners. This allowed the team to ensure clarity, messaging consistency, and preparedness for potential media queries—especially given the film’s unique direct-to-digital launch strategy during the pandemic.

3. Influencer Brief Simulations:

The team prepared influencer briefs in advance for Malayalam film reviewers, popular YouTubers, and Instagram creators. These briefs included suggested posting times, hashtags, and talking points. Influencers took part in mock campaigns, aligning their posts with the film’s official content schedule to guarantee a coordinated digital push when the film launched.

Outcome:

The execution simulation enabled a smooth, high-impact promotional rollout. “Drishyam 2” quickly trended on social media, with positive buzz amplified by influencers and timely press coverage. The seamless, well-orchestrated campaign contributed to the film’s rapid success on digital platforms and strong word-of-mouth both in Kerala and among the global Malayali audience.

Other Mollywood Examples

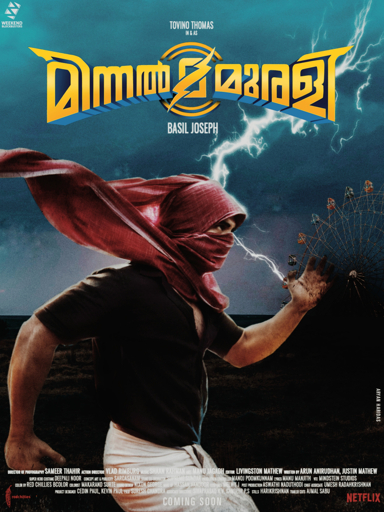

- “Minnal Murali” (2021):

The superhero film’s team rehearsed Twitter and Instagram campaigns, including coordinated influencer challenges and memes, ahead of the Netflix release. Press release simulations helped manage international media outreach, given the film’s global appeal. - “Kurup” (2021):

Influencer and social media simulations ensured that the film’s period look and teaser releases were amplified across Malayalam and other South Indian online communities, with pre-prepared responses for anticipated fan questions and viral moments.

Conclusion:

Execution simulation of promotional activities—including mock social media rollouts, press release rehearsals, and influencer briefings—has become an important success factor in Mollywood. These careful preparations help Malayalam films deliver impactful, synchronized campaigns that maximize audience engagement and contribute to box office and streaming success.